How Credit Repair Can Adjustment Your Life: What You Need to Recognize

How Credit Repair Can Adjustment Your Life: What You Need to Recognize

Blog Article

A Comprehensive Overview to How Credit Scores Repair Can Change Your Credit History

Comprehending the ins and outs of credit repair is important for any individual looking for to boost their economic standing. By addressing problems such as payment history and credit rating usage, people can take positive steps towards boosting their credit score scores.

Recognizing Credit Rating Ratings

Recognizing credit report is important for anybody seeking to improve their financial health and access much better loaning options. A credit history is a numerical depiction of a person's credit reliability, generally varying from 300 to 850. This score is produced based on the info had in an individual's credit record, that includes their credit score history, arrearages, repayment background, and kinds of charge account.

Lenders utilize credit rating to analyze the danger related to providing cash or prolonging credit rating. Higher ratings show reduced threat, often resulting in more desirable financing terms, such as reduced interest prices and higher credit rating limitations. On the other hand, reduced credit report can lead to higher rate of interest or rejection of debt altogether.

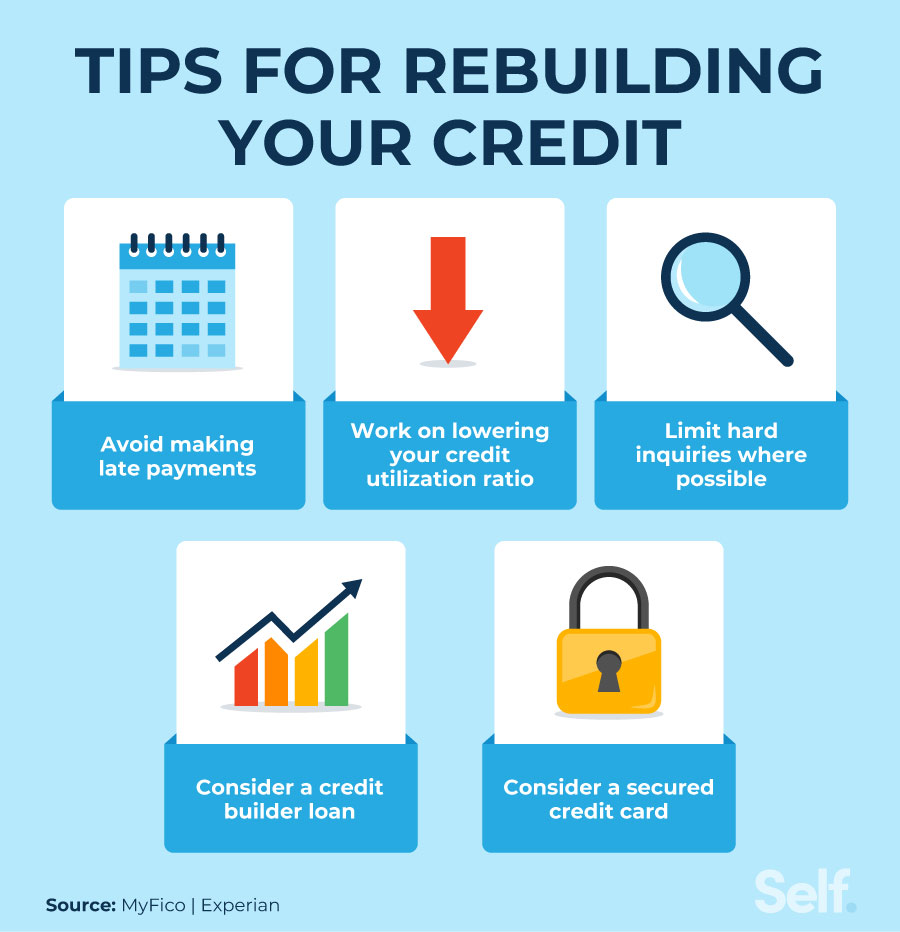

Several elements influence credit report, consisting of settlement background, which makes up roughly 35% of the rating, adhered to by credit history use (30%), size of credit rating (15%), kinds of credit score in operation (10%), and brand-new credit score questions (10%) Recognizing these aspects can equip individuals to take actionable steps to boost their ratings, eventually improving their monetary opportunities and stability. Credit Repair.

Usual Credit Rating Issues

Many individuals face common credit history problems that can impede their financial progression and influence their credit score ratings. One common concern is late payments, which can dramatically harm credit report ratings. Also a single late settlement can stay on a credit history report for a number of years, impacting future loaning potential.

Identification burglary is another major concern, potentially leading to deceitful accounts appearing on one's credit score record. Dealing with these typical credit scores issues is essential to boosting monetary health and developing a strong credit rating account.

The Credit Report Repair Work Refine

Although credit score repair work can appear overwhelming, it is a methodical process that people can carry out to boost their credit rating ratings and remedy mistakes on their credit records. The initial step involves obtaining a duplicate of your credit score report from the 3 significant debt bureaus: Experian, TransUnion, and Equifax. Testimonial these reports carefully for discrepancies or errors, such as incorrect account information or out-of-date information.

As soon as errors are determined, the following action is to dispute these mistakes. This can be done by contacting the credit rating bureaus directly, giving documentation that supports your insurance claim. The bureaus are called for to investigate conflicts within 30 days.

Maintaining a consistent payment history and managing credit report view publisher site application is additionally crucial during this process. Monitoring your credit score regularly guarantees ongoing precision and assists track renovations over time, enhancing the performance of your credit repair efforts. Credit Repair.

Benefits of Credit History Repair Work

The advantages of credit fixing prolong far past just boosting one's credit report; they can substantially affect financial security and opportunities. By addressing mistakes and negative things on a credit score record, individuals can enhance their creditworthiness, making them extra appealing to loan providers and banks. This enhancement frequently brings about far better rates of interest on financings, reduced costs for insurance, and boosted chances of authorization for bank card and mortgages.

In addition, credit history fixing can assist in accessibility to crucial solutions that require a credit scores check, such as renting out a home or obtaining an utility solution. With a healthier credit rating account, people might experience boosted confidence in their economic choices, enabling them to make bigger acquisitions or financial investments that were formerly out of reach.

Along with tangible monetary benefits, credit repair work promotes a feeling of empowerment. People take control of their economic future by proactively managing their credit history, bring about more informed choices and greater monetary proficiency. On the whole, the advantages of credit repair service add to a much more secure monetary landscape, inevitably promoting long-term financial growth and individual success.

Picking a Debt Repair Work Solution

Choosing a credit score repair work solution requires cautious factor to consider to ensure that people receive the support they need to enhance their monetary standing. Begin by investigating prospective business, concentrating on those with positive client testimonials and a tested track document of success. Openness is vital; a trustworthy service should plainly outline their timelines, procedures, and charges in advance.

Next, verify that the credit history repair work service adhere to the Credit score Repair Organizations Act click to read more (CROA) This government regulation secures customers from misleading practices and collections standards for credit rating repair work services. Avoid companies that make impractical assurances, such as guaranteeing a specific rating boost or declaring they can eliminate all negative items from your record.

In addition, think about the level of customer you could check here support provided. A good debt fixing solution need to supply individualized assistance, allowing you to ask concerns and receive timely updates on your progression. Search for solutions that supply an extensive evaluation of your credit history record and develop a personalized approach tailored to your certain scenario.

Ultimately, picking the best credit fixing solution can result in significant renovations in your debt rating, equipping you to take control of your economic future.

Final Thought

Finally, effective credit history repair work methods can considerably enhance credit history by attending to typical concerns such as late repayments and inaccuracies. A thorough understanding of credit rating aspects, combined with the involvement of respectable credit rating repair service services, helps with the settlement of adverse items and recurring progress tracking. Inevitably, the effective improvement of credit rating not just brings about much better lending terms however also cultivates higher financial possibilities and security, highlighting the significance of proactive credit history administration.

By addressing concerns such as settlement history and credit scores utilization, people can take positive steps towards enhancing their credit ratings.Lenders use credit history scores to examine the threat associated with offering money or expanding credit score.One more constant problem is high debt use, specified as the ratio of existing credit report card balances to overall offered credit history.Although credit history repair work can seem difficult, it is an organized process that people can embark on to boost their credit score scores and remedy errors on their credit history records.Following, validate that the credit scores repair work solution complies with the Debt Repair Organizations Act (CROA)

Report this page